STRATEGY GUIDE

Navigating turbulent tariffs

How dealers can protect profits and improve the customer experience amid rising costs

With 25% tariffs now in effect on all automotive-related imports, dealers are entering another era of cost pressure. Early projections show that the average cost of a new vehicle — already at a record high of $49,000 — could climb by an additional $5,000 to $10,000. That jump translates to an extra $100–$200 per month for the average buyer on a five-year loan. For many shoppers, that additional cost may push new-car ownership out of reach entirely.

This isn’t just a matter of consumer affordability — it’s a direct hit to dealer profitability. The Banks Report projects a 10–20% decline in new vehicle sales as buyers retreat from rising prices. Meanwhile, used vehicle demand is expected to spike, placing even more pressure on an already limited supply of quality pre-owned inventory.

Subscribe to the Cars Commerce Industry Insights Report for timely updates on how tariffs and other market shifts are impacting shopper behavior, pricing trends, and inventory demand.

How Cars Commerce helps you navigate change

Tariffs may be out of your control — but how you adapt to them isn’t. Cars Commerce gives you the connected tools to protect profits, engage buyers, and move inventory confidently in a shifting market:

Cars.com connects you with in-market shoppers who are looking to buy now — while helping you build a reputation that drives trust-based decisions.

Dealer Inspire helps shoppers overcome affordability barriers with embedded tools that clarify monthly payments before they visit your store.

AccuTrade gives you real-time, VIN-level insights to price proactively, forecast profitability, and avoid overcommitting to high-risk vehicles.

DealerClub offers a trusted wholesale network to quickly source or offload inventory as market conditions shift, allowing you to stay flexible without losing margin.

Cars Commerce Media Network helps you reach real in-market shoppers across channels using Cars.com first-party data.

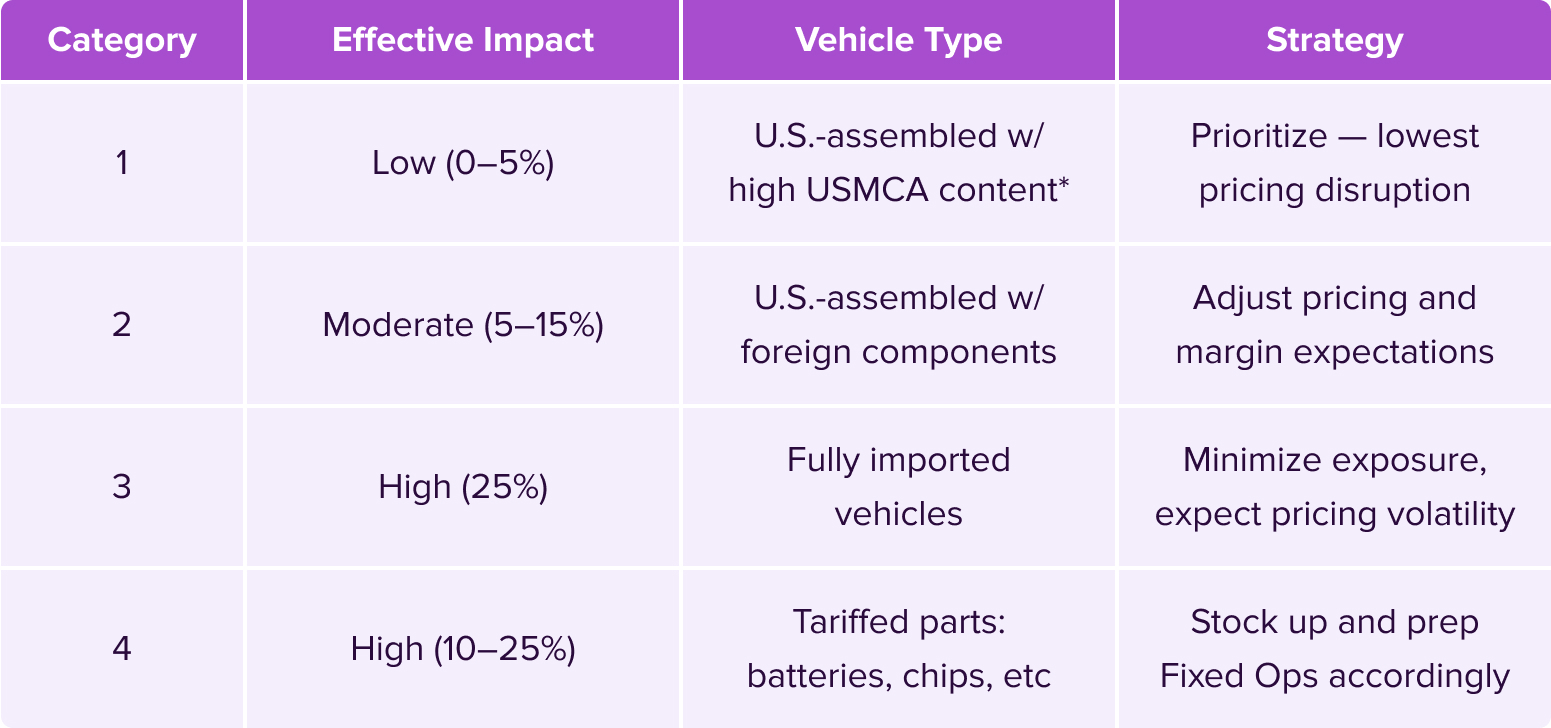

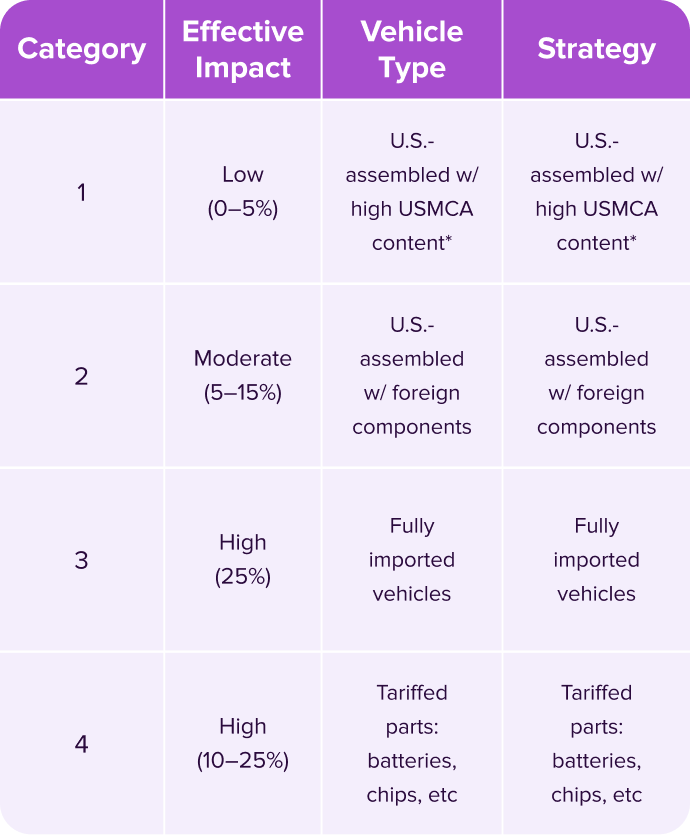

Tariff exposure: what dealers need to know upfront

While tariffs are hitting the industry at full force, not every vehicle or part on your lot will feel the same pressure. The degree of pricing disruption depends on two factors: where a vehicle was assembled and how much of its content comes from outside the USMCA region.

Use the chart below to assess exposure across your inventory — and make proactive decisions to protect margin, prioritize sourcing, and communicate value to shoppers.

Tariff Sensitivity by Assembly & Content

A guide to understanding which vehicles may feel the biggest pricing pressure

*Vehicles with high USMCA content are currently considered less tariff-exposed, but this may change as enforcement of sourcing rules evolves. Even U.S.-assembled vehicles could face pricing pressure if they include foreign-sourced high-tariff components.

Understanding the true impact on your profitability

Tariffs don’t just change what customers pay — they affect every line of your dealership’s balance sheet. As new cars become more expensive, demand is expected to decline. And with OEMs under shareholder pressure to protect their own earnings, aggressive incentive programs to bring buyers to market aren’t likely to come to the rescue any time soon.

These market dynamics will naturally lead to used cars becoming the more in-demand alternative. But that segment is under its own pressure, with late-model inventory shrinking due to reduced leasing volume and pandemic-era production gaps. In fact, supply of in-demand used vehicles is projected to drop another 6.7% in 2025 alone1 — even as demand surges.

And then there are your customers — navigating already high interest rates, fewer choices, and now more financial uncertainty. In this climate, your dealership’s path to profitability must come from standing out in meaningful ways: delivering transparent, trust-driven experiences, providing affordability tools that empower shoppers, and investing in digital strategies that reach real buyers efficiently.

Turn uncertainty into action

Tariff-driven price increases aren’t just creating sticker shock — they’re creating decision paralysis. Shoppers are asking: What should I buy? Where can I find it? Can I even afford it anymore?

Many in-market consumers are navigating a drastically different landscape than they’ve experienced before. A lease-return customer may suddenly be priced out of their preferred make due to shifting incentives or import exposure. A used buyer may be struggling to find the right combination of price, mileage, and availability — especially in a market where late-model inventory is tightening.

This is exactly where the Cars.com Marketplace proves essential. Even before tariffs, 71% of Cars.com shoppers were undecided2 — unsure of what to buy or who to buy from — and used the platform’s listings, reviews, and editorial content to narrow their decision.

Put your cars where the shoppers are. With added price sensitivity, used-car shoppers will expand their search radius to explore all options. You can’t sell a car if you aren’t showing up.

Marketplace visibility helps shoppers find your inventory — but what convinces them to choose your store is the trust you’ve built. In a high-stakes, high-cost market, your reputation isn’t just a reflection of past performance. It’s a reason to buy now.

Stand out through experience and reputation

Today’s shoppers rely heavily on reviews to guide their decisions — and that behavior only intensifies during economic uncertainty. Dealers who actively collect and promote fresh customer reviews will stand out, while those with outdated feedback risk being overlooked.

That makes review generation more than a nice-to-have — it’s a core revenue lever. Every sale, every service appointment, every handoff is an opportunity to build credibility and trust.

Automated Review Building is included in Cars.com Marketplace Premium subscription packages.

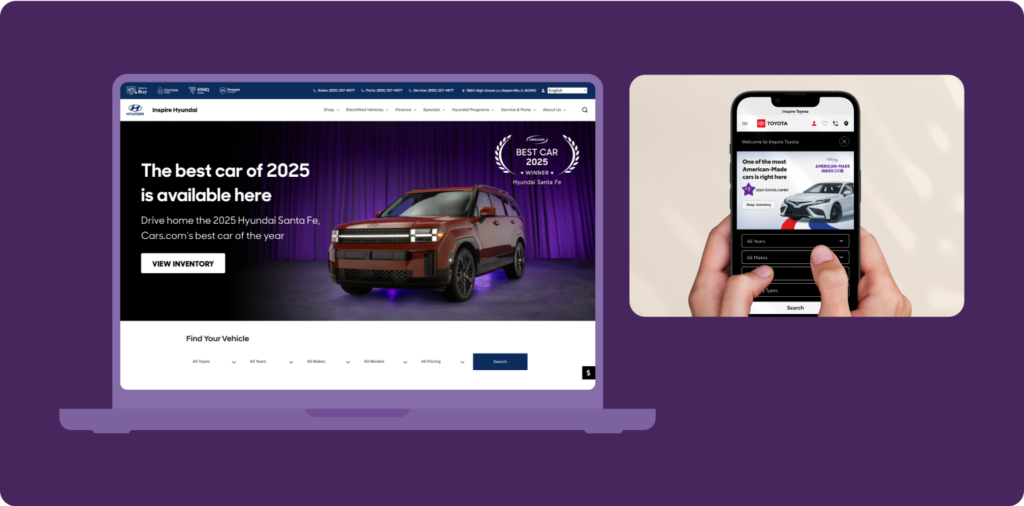

Equally important is how your reputation and differentiators show up on your website. When pricing isn’t a competitive edge, your story has to be. Leverage homepage banners and SRP callouts to promote your experience, emphasize value-added assets like Cars.com’s Best Value badges or your OEM’s inclusion in the American-Made Index; and reinforce your dealership’s promise across every shopping touchpoint.

Your digital storefront is where first impressions are made. During a time when shoppers are weighing every dollar, make sure yours communicates confidence, transparency, and ease.

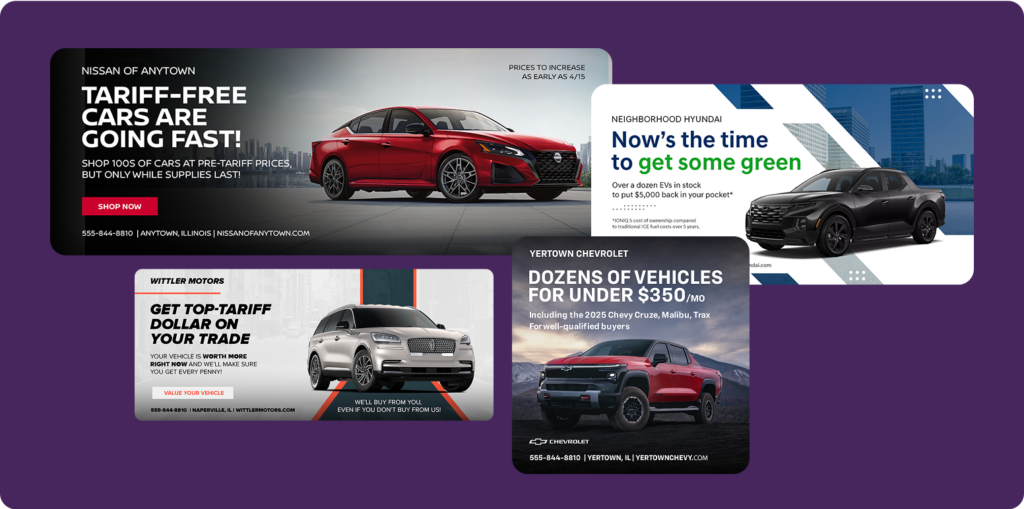

Messaging strategies that move shoppers

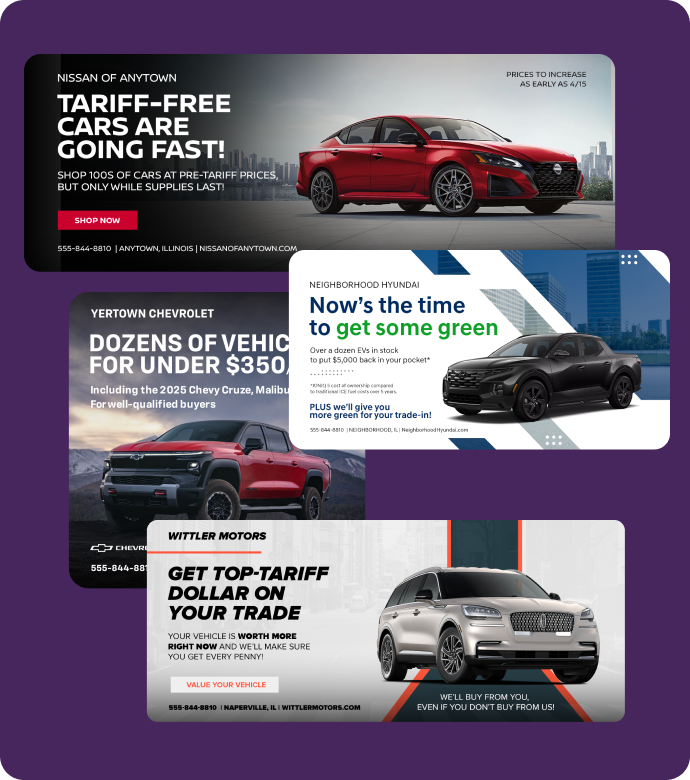

Tariffs and affordability concerns are driving shoppers to weigh their decisions more carefully — and your messaging needs to meet them where they are, with clarity, urgency, and confidence.

Use these creative themes to shape your marketing and website messaging, helping shoppers navigate uncertainty and move forward with your dealership.

The time to buy is now

Show shoppers why today is the right time to buy with messaging that creates urgency. By highlighting your pre-tariff inventory, you can give shoppers a clear reason to take action before prices climb.

Affordable vehicles

When affordability is top of mind, point shoppers to your most budget-friendly options, like “under [$XX,XXX]” listings or special lease offers. Helping them quickly find vehicles that fit their price range builds trust and drives engagement.

Fuel efficiency / cost to own

Tariffs may raise sticker prices, but messaging focused on long-term savings helps balance that out. Emphasize fuel efficiency, reliability, and overall cost of ownership to help buyers justify their decision and feel confident in their investment.

Vehicle acquisition

Let shoppers know their trade-in is worth more right now. With used vehicle values rising due to tariff-driven demand, messaging that spotlights this value can motivate consumers to sell or trade sooner — and bring more inventory into your pipeline.

Ask us anything

Make it easy for shoppers to start a conversation. Use messaging that invites questions, highlights your team, or personalizes the buying experience. In uncertain times, a warm, approachable tone lowers the barrier to engagement and makes your dealership feel like a trusted resource.

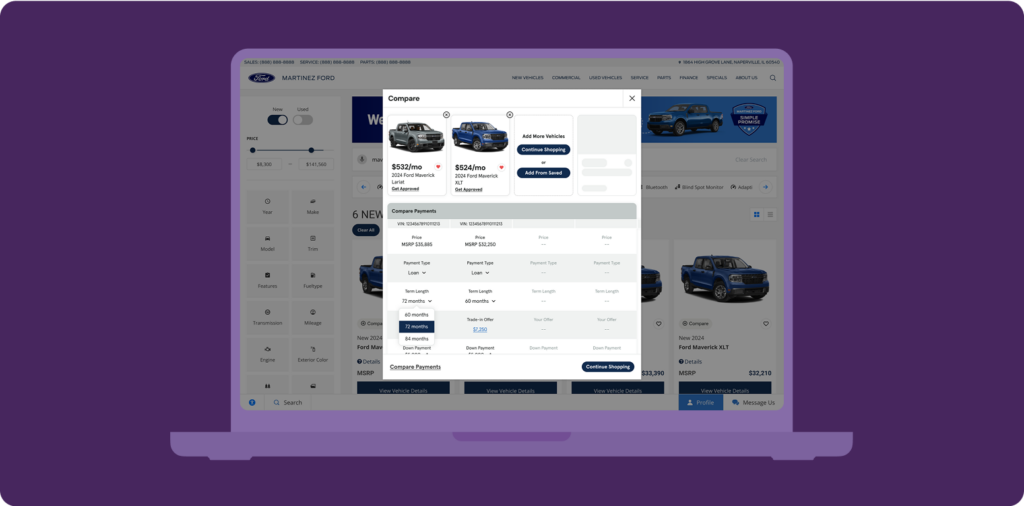

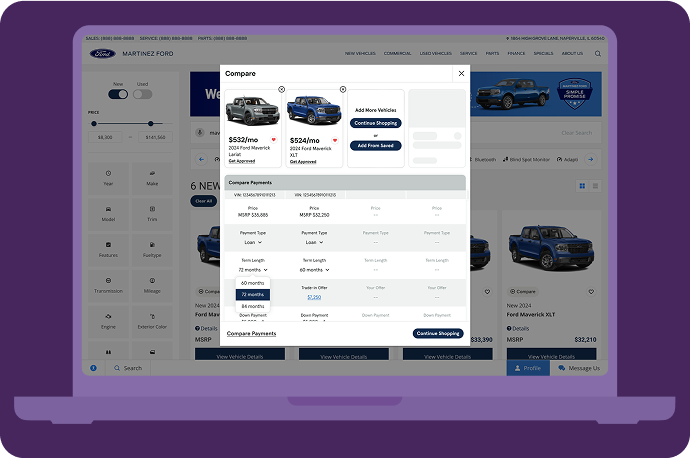

Make affordability easier to navigate

As shoppers face higher monthly payments and tighter lending terms, they need help understanding what they can actually afford. The dealerships that provide that clarity will be the ones that move deals forward.

One of the most effective ways to do this is by putting affordability tools directly into the shopper’s hands. Give them the ability to estimate monthly payments based on their credit profile, the value of their trade-in, and selected terms.

And don’t make them wait. Whether through AI-powered chat, SMS, or live phone support, be available to answer real affordability questions — not just capture a lead — when they’re actively shopping on your website.

These tools don’t just improve the experience, they build trust. By allowing customers to self-qualify and make informed decisions, you’re removing guesswork and replacing it with transparency. And in a time of uncertainty, that makes all the difference.

Reallocate ad budget to real buyers

When economic pressure rises, so do digital advertising costs. That’s especially true on crowded platforms like Google, where more dealers are competing for fewer shoppers and paying more for every click. In a market like this, chasing general traffic isn’t just inefficient. It’s a direct threat to your ROI.

In fact, customer acquisition through third-party audience data is, on average, 19 times more expensive than using first-party data3 — making it one of the least efficient ways to reach real buyers in today’s market.

Now is the time to shift your budget away from broad targeting and toward verified in-market shoppers — the people already searching, comparing, and shopping on Cars.com. With more than two decades of consumer behavior data and millions of monthly visits, Cars.com offers one of the most powerful first-party audience sets in automotive.

With Cars Commerce Media Network, you can activate that first-party audience across every major digital channel — search, social, display, and video — and surround your highest-value prospects with your brand, your inventory, and your message. Even as cookies disappear and third-party targeting becomes less reliable, Cars.com shopper data gives you a direct line to the people who are actively shopping in your market right now.

In-Market Display Tentpole can help you move tariff-free inventory faster by reaching in-market shoppers with a clear message: buy now, before prices rise.

And because all of your media is unified through one platform, performance becomes easier to manage and optimize. Our AI-powered campaign tech continuously reallocates spend toward the creative, channels, and VINs driving actual results — not just impressions.

In uncertain times, the smartest investment you can make is in media that doesn’t guess. It knows your audience — and knows exactly how to reach them again and again.

Import inventory from your service drive

In a market where used inventory is both scarce and expensive, your service drive is the most underutilized acquisition channel on your lot — and also the most reliable. Every service visit is an opportunity to start a trade-in conversation, especially with customers driving high-demand, high-value vehicles they may not realize are worth more than ever.

Now is the time to make your Fixed Ops department a key part of your inventory strategy. With AccuTrade integrated into your service drive process, your advisors can offer instant appraisals and diagnostic scans that give customers clear, no-pressure insights into their vehicle’s current condition and trade-in value without disrupting the service experience.

This creates a low-friction handoff to your sales team and opens the door to more warm leads, more trades, and more opportunities to source inventory without going to auction.

Use QR codes in your waiting area to let customers initiate an instant appraisal from their own device while their car is being worked on.

See how.

Use real-time data to maximize profit

When used vehicles become more expensive and harder to find, the stakes for each acquisition decision get higher — and so does the cost of getting it wrong. Dealers can no longer afford to acquire inventory reactively. It’s time to think like a trader, not just a retailer.

Pro Tips from high-performing dealers:

- Target <28 days of supply — anything over that erodes margin fast.

- Cap auction dependency at 30% or less.

- Use real-time market tools that update daily — not legacy systems stuck on 45-day lookbacks.

- Appraise 1.5x your retail volume — and miss less than 10% of trades.

With AccuTrade, dealers can evaluate each VIN not just on current comps, but on real-time demand signals and predictive performance. You’ll know which vehicles are worth acquiring, how to price them, and when to exit — before they hit your lot.

And when a car isn’t a fit for your retail strategy, you shouldn’t be stuck with it. DealerClub offers a one-click wholesale off-ramp and a new channel to acquire inventory from verified, reputation-rated peers. That means more flexibility, more liquidity, and more opportunity to move metal without taking a hit on margin.

Inventory management isn’t about pricing anymore — it’s about planning. Treat your lot like the investment portfolio it is, and make every vehicle work for your bottom line.

Unlock new value from every profit center

When sales margins shrink, every other department needs to step up — and that includes F&I and your retail parts counter.

In the F&I office, customers may be more hesitant to add appearance packages or wheel and tire protection to already expensive deals. But products like GAP insurance, extended warranties, and pre-paid maintenance become even more essential when the cost of vehicle replacement climbs.

As EV tax credits face potential repeal and tariffs inflate battery prices, hybrids may experience a demand rebound. Consider bundling long-term service and warranty packages for these models to build margin while giving shoppers peace of mind on total cost of ownership.

Even your retail parts counter has untapped potential, as shoppers searching for OEM components may be closer to buying or selling than you think. Crosstrain you counter staff to ask a few deeper questions about a customer’s parts purchase to identify areas of opportunity for service R/O’s, vehicle acquisitions, or even a new car.

Strategy is your advantage

Tariffs may reshape the economics of car buying — but your strategy is still your strongest advantage. Dealers who lead with transparency, price with precision, and market with intention won’t just protect their margins — they’ll outperform the market

Let’s talk about how Cars Commerce can help you turn uncertainty into opportunity.

1Cars Commerce Industry Insights, February 2025

2Cars.com Consumer Metrics Q2 2024

3DV360 data, analysis of first party remarketing vs prospecting, 9/19/2023 to 12/17/2023