Industry Insights Report

| Q1 2025

Auto Sales Surge in First Quarter of 2025,

But Tariffs and Affordability Raise Concerns

View Full Report

Auto Market Pops in First Quarter — But Tariffs and Affordability Are Clouding the Road Ahead

The auto industry kicked off 2025 with a bang, but under the surface, signs of strain are starting to show — especially when it comes to affordability. Between pre-tariff buying sprees, stubbornly high prices and tightening inventory at the low end of the market, the first quarter was anything but boring.

March Madness: Buyers Rush in Before Tariffs Hit

March 2025 was one for the record books. With a seasonally adjusted annualized rate of 17.8 million, it was the sixth-best March in 50 years of sales data. And that wasn’t by accident.

Consumers rushed to buy before tariffs started driving up prices, creating a pull-ahead effect that gave March a huge boost. Add in tax refunds and a flood of automaker incentives, and there is the perfect storm for a blockbuster month causing March sales to grow 11% YoY, pushing the Q1 average up 4.8% YoY despite a softer 1% gain for January and February.

Overall, new-car sales hit 3.9 million units in the first quarter, a gain of 4.8% year over year and the 11th best first quarter in 50 year, according to the U.S. Bureau of Economic Analysis. Even after a slower start in January, the quarterly SAAR hit 16.4 million, a pace that’s significantly ahead of 2024’s 15.9 million sales.

Inventory Is Back — But So Are the Price Problems

On the surface, inventory’s looking healthier: New-car supply rose 9% year over year, and cars are spending more time on lots again — 78 days on average, which is right in line with pre-pandemic norms.

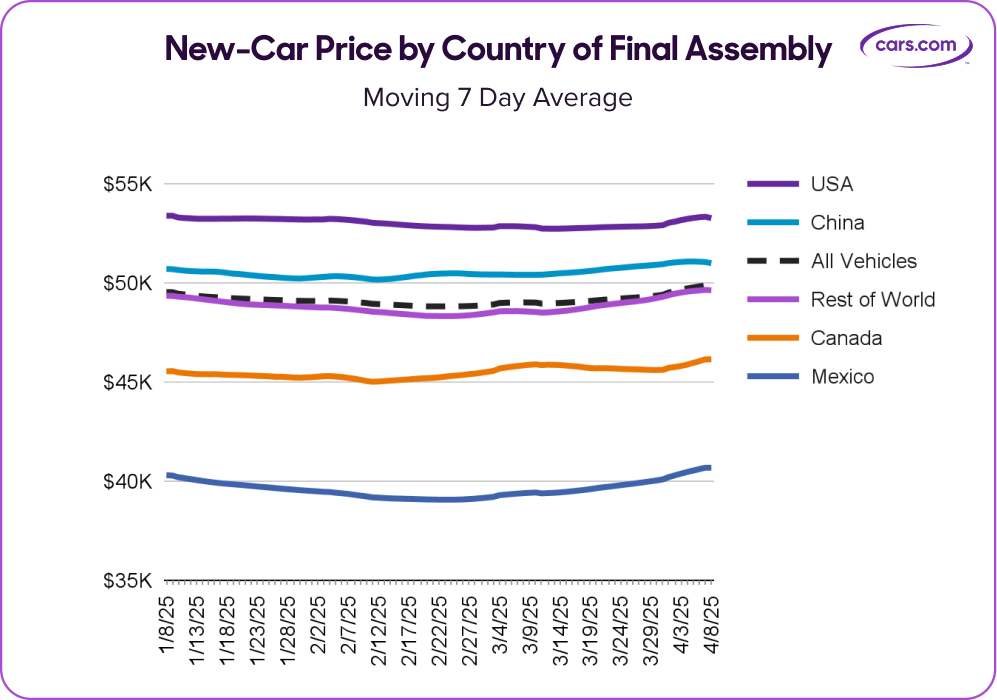

But prices? Still high. The average new-vehicle price has hovered around $49,000 for the last 18 months, nearly 30% higher than pre-pandemic levels. And with tariffs impacting the cost structure of many imported models, that price plateau may not hold much longer.

Entry-Level Cars Are Becoming a Challenge

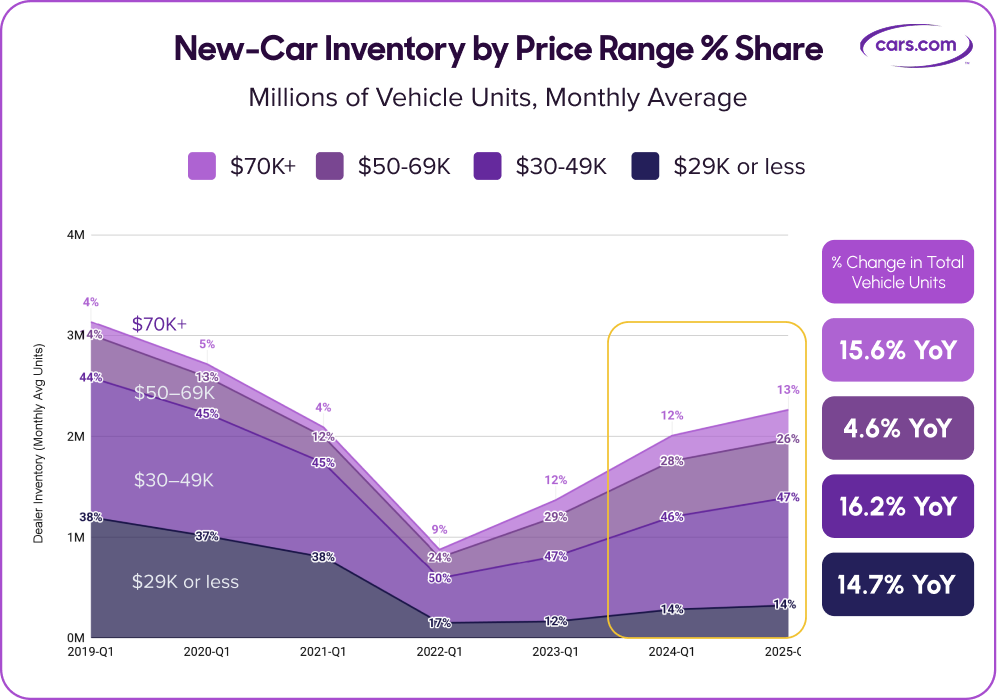

Cars priced under $30K now make up just 14% of inventory, down from 38% in 2019-21. And the majority of those remaining budget-friendly vehicles? Nearly 90% are built outside the U.S. — making them especially vulnerable to import tariffs.

That leaves only three sub-$30K models still built in the U.S. — Honda Civic, Toyota Corolla and the soon-to-be discontinued Chevy Malibu. Although it is worth noting that almost half Civics are imported from Canada, and about a quarter of Corollas are from Japan.

Meanwhile, the $30K-$49K range is now the fastest-growing segment, making up nearly half of all inventory. Some shoppers can adjust, but the shift leaves first-time buyers and lower-income consumers with fewer options.

And even though the Federal Reserve cut rates by a full percentage point in late 2024, auto-loan APRs still rose 19 basis points year over year in the first quarter. Lenders are being cautious, and for buyers already stretched thin, it’s just one more hurdle.

EVs Are Hot, and Shoppers Have More Options

After some tough times for electric vehicles, the first quarter was a big quarter for this segment— there are now 69 new EV models on the market, up from 49 a year ago. Legacy automakers like GM and Honda are finally scaling production, and their joint platform saw inventory jump 258% year over year.

But prices ticked up here, too — new EVs got 3% more expensive thanks to a wave of high-end launches. Still, days-on-lot times for new EVs dropped to an average of 82 days, down from 90 days a year ago, suggesting that buyers are motivated — especially with the federal EV tax credit still available and tariffs looming.

The used EV market is also heating up, and Tesla isn’t the only game in town anymore. In fact, shoppers are increasingly gravitating toward non-Tesla brands, which are gaining momentum thanks to newer models and lower prices, which is leading to shorter time on the lot. Used EV inventory jumped 27% year over year in the first quarter, with non-Tesla brands outpacing Tesla’s growth. There are now 78 used EV models available, up from the 58 a year ago, giving consumers a wider range of choices.

Non-Tesla EVs also moved more quickly, with an average of 68 days on the dealer lot, three days faster than the year prior, while used Teslas sat on the lot five days longer, in part because their average product age now exceeds seven years. Pricing reflected that shift: Used Tesla prices dropped 8% year over year, while other EV brands declined just 3% buoyed by fresher designs and updated technology.

Trade-In Values Set to Increase

Used-vehicle trade-in values rose 1.9% year over year in March, the first March increase since 2022. That said, the month-over-month increase was just 0.15%, the softest month-over-month gain in March since 2020 when the pandemic disrupted typical seasonal trends. Typically, used car values increase from February to March driven by tax returns and elevated consumer demand. Market uncertainty and delayed policy announcements likely kept some shoppers on the sidelines. But if tariffs send new-car prices higher, expect trade-in values to follow.

Outlook: A Balancing Act Ahead

The first quarter brought strong demand, but the pressure is rising. The market is moving fast, and so are consumers — but the threats of tariffs, high prices and shrinking entry-level vehicles could reshape the second half of the year. As we saw during the pandemic, cars were — and still are — essential to daily life, from getting to work to taking care of family. That reality hasn’t changed, but the path to ownership is becoming more complicated for many shoppers. The next few months will show how resilient both automakers and consumers really are.

David Greene

Industry and Marketplace Analytics Principal, Cars Commerce

Q1 2025 full report

Dive deep into our monthly report for a closer look at key industry trends and actionable insights for your corner of the market.

Subscribe for our

monthly report

Keep your finger on the pulse of the latest industry trends and receive our team’s insights by subscribing to our monthly report.