Industry Insights Report | January 2025

Tariffs, EV Deals and the Hunt for Affordable Rides

View Full Report

January 2025 came in with a mix of steady pricing, tariff drama and a growing love for hybrids. If you were in the market for a car, you probably noticed that prices didn’t budge much, but hey — at least inventory was up!

Let’s dive into what happened in the automotive world last month.

Tariffs and Trade: Will Prices Stay Put?

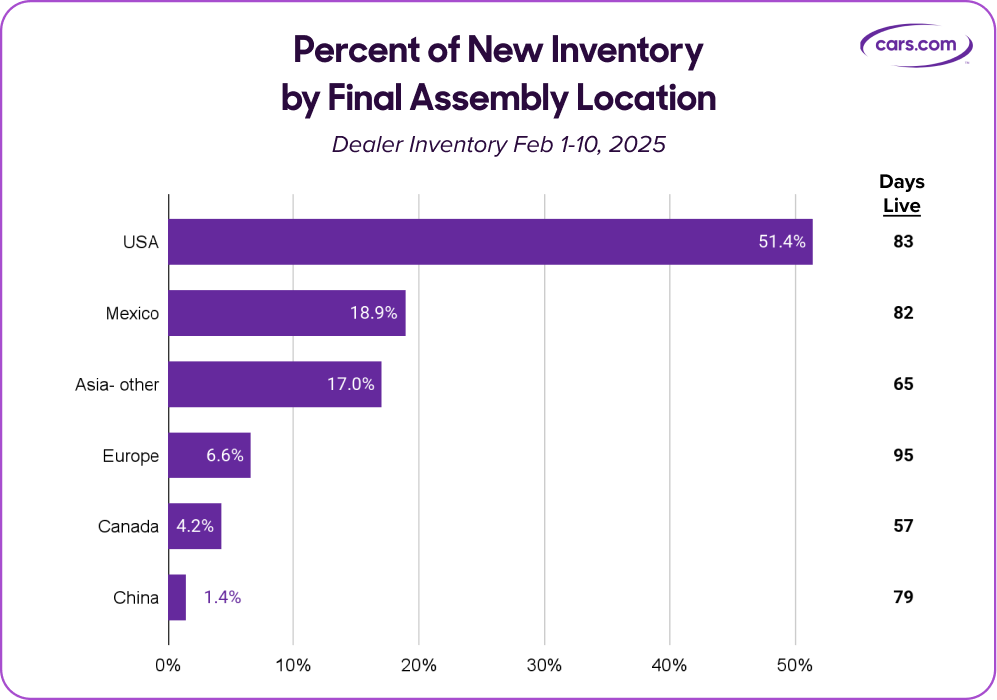

Here’s the deal: The 10% tariff on goods from China is officially in effect. But before you panic, keep in mind that only 1.4% of new-vehicle inventory actually comes from China. The vehicles feeling the impact most? The Buick Envision and the Lincoln Nautilus, which account for 93% of inventory imported from China. The other 7% includes models from Volvo and Polestar, both owned by Chinese automaker Geely.

Now let’s talk North America. 23% of new cars on dealer lots are imported from Canada and Mexico. But here’s a surprise: Fifty-one percent of that inventory may have a Detroit-based badge on the hood. Yep: GM, Ford and Stellantis all build vehicles in Canada or Mexico and ship them stateside. And it isn’t just the traditional Big Three brands — 36% of Japanese-brand inventory are also imported from these two countries.

The global nature of the automotive industry means that a “domestic” or “foreign” brand isn’t always what you think. For example, Honda builds the Passport, Odyssey, Pilot and Ridgeline in Alabama, while Ford makes the Bronco in Michigan — but the Bronco Sport? That’s built in Mexico.

More Cars, Steady Prices and EV Uncertainty

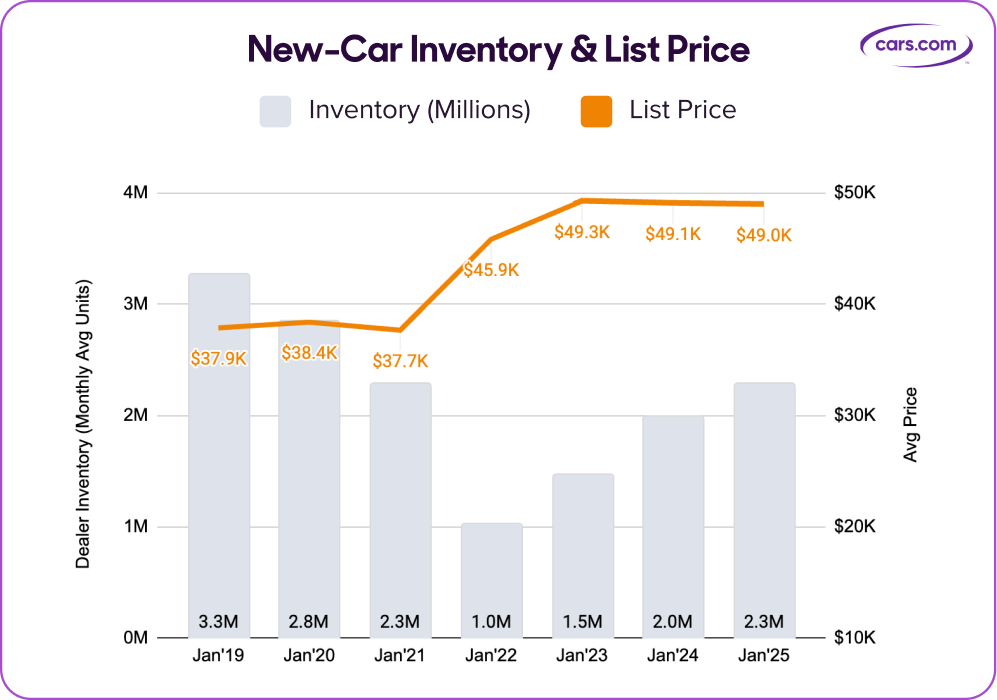

New-car prices held steady at $49,000, but inventory jumped 15% YoY, giving shoppers more choices. Ford (+30%) and Hyundai (+44%) stocked up, while Ram (-11%) and Lexus (-32%) cut back. Instead of launching budget models, automakers are offering better-equipped trims at lower prices. Affordable options are growing, with cars under $30,000 up 27% YoY — fastest-growing models include the Kia K4, Chevrolet Trax and Nissan Sentra. Meanwhile, buyers ditched mid-size SUVs for cheaper options, while luxury SUVs and heavy-duty trucks saw strong demand.

Used-car prices dipped -1.8% YoY to $28,368, but a shrinking supply of newer used cars (0-6 years old) could push prices back up. A win for budget shoppers? Used cars under $10K jumped 17.3% YoY.

New-electric-vehicle inventory surged, led by GM and Honda, but even with discounts and tax credits, new EVs sat on lots for 85 days as buyers grew more selective. Used EVs also dropped 6% in price, making them a bargain — but Tesla lost market share as more competitors entered the mix.

The entire industry is in wait-and-see mode as the new administration continues to surprise us with new potential tariffs and shifting EV policies, while a tightening used supply could further shake things up later in 2025.

David Greene

Industry and Marketplace Analytics Principal, Cars Commerce

January 2025 full report

Dive deep into our monthly report for a closer look at key industry trends and actionable insights for your corner of the market.

Subscribe for our

monthly report

Keep your finger on the pulse of the latest industry trends and receive our team’s insights by subscribing to our monthly report.